NEW YORK (CNNMoney)

The political turmoil is rooted in the country's strategic economic position. It is an important conduit between Russia and major European markets, as well as a significant exporter of grain.

But in the post-Soviet era, it's a weakened economy. Now, the government is in need of an economic rescue -- and torn between whether Russia or the Western economies (including the European Union) is the savior it needs.

Here are five reasons the world's largest economies are watching what happens in Ukraine.

1. Ukraine is an important tie between Russia and the rest of Europe: Ukraine doesn't hold the economic power it once did, but it does retain its geography. Russia supplies about 25% of Europe's gas needs, and half of that is pumped via pipelines running through Ukraine. Moscow has cut off that flow in past disputes with Kiev and a disruption could push up energy prices for businesses and households.

The critical Crimean peninsula juts into the Black Sea, and the Russians base their Black Sea navy there.

Related: G20 pledges to add $2 trillion to economy

2. Sanctions on Russia: One prospect on the table would be the unusual circumstance of a top-10 global economy placing sanctions on another. But Secretary of State John Kerry said Sunday the U.S. is "absolutely" willing to consider sanctions against Russia. President Obama, he added, "is currently considering all options."

That possibility must be on the mind of Russia's government, which is certainly "looking very seriously at the economic component of" its military and diplomatic moves, said John Beyrle, a former U.S. ambassador to Russia.

"The reality is that Russia is dependent on the international economy in a way that wasn't true 10 years ago," Beyrle said Sunday on CNN's "State of the Union." "Fully one -half of Russia's foreign trade now ... is with European Union countries. Russia depends on European imports to keep its stores filled, to keep the standard of living that Russians have gotten accustomed to."

Even if sanctions aren't leveled, the political relationship between Russia and the West will likely chill. Although President Obama spent an hour and a half on the phone with Russian President Vladimir Putin on Saturday, the U.S. is expected to skip an upcoming G8 preparatory meeting in Sochi, Russia. On Sunday, U.S. officials also canceled upcoming energy and trade talks with their Russian counterparts.

3. European and world trade could be impacted: The impact could be felt beyond Europe if the world's supply of grain is impacted. Ukraine is one of the world's top exporters of corn and wheat, and prices could rise even on concern those exports could halt.

And the current political uprising was fueled by the government's handling of a trade agreement that would have brought Ukraine closer to the European Union. The government cut off negotiations in November amid pressure from Russia, which offered discounts on natural gas if Ukraine signed a pact with Moscow's Customs Union.

4. Ukraine's government is in debt and needs assistance: The situation arguably would not be so volatile if Ukranian government coffers were more stable or the economy stronger. The country owes $13 billion in debt this year and $16 billion comes due before the end of 2015. Without help, the country appears to be headed for default.

"In order to avoid a complete collapse in the coming weeks, Ukraine needs money now," Lubomir Mitov, emerging Europe chief economist at the Institute of International Finance, said. "Ukraine cannot survive without reforms in the next few months."

It's not clear who would supply the needed economic assistance, especially after the ouster of key Russian-aligned officials prompted Moscow to freeze a $15 billion bailout and there is no comparable alternative in sight. The most likely source of support would be the International Monetary Fund. Managing Director Christine Lagarde said the IMF is consulting with other bodies that could help raise the $35 billion Ukraine says it needs. But for negotiations to move forward, a stable Ukranian government would need to be in place.

Treasury Secretary Jack Lew said Sunday the U.S. is "prepared to work (with) partners to provide as much support as Ukraine needs" for economic growth and stability.

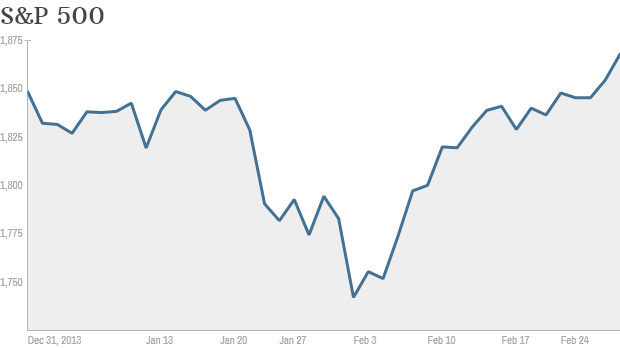

5. Ukraine isn't the only fragile emerging market: Ukraine's instability comes at a difficult time for emerging markets worldwide, which are seeing growth slow as the Federal Reserve eases its economic stimulus. The situation in Ukraine could lead investors to reassess the risks of other emerging markets slowing economic growth. Troubles in Ukraine will also hurt Russian banks, which have leant heavily to Ukraine. The Russian ruble is down about 10% since the start of 2014.

--CNNMoney's Alanna Petroff contributed to this report ![]()

First Published: March 2, 2014: 4:57 PM ET