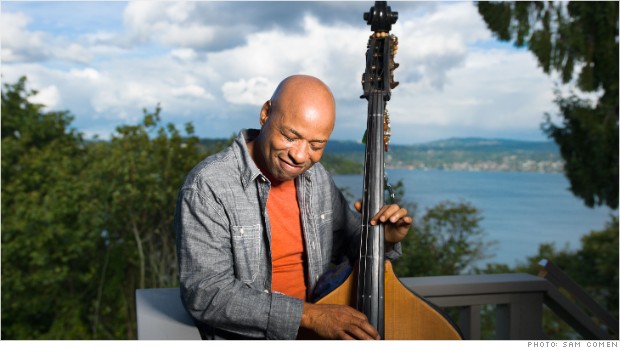

In the 1980s, Kevin Howard started buying houses, fixing them up, and renting them out. That rental income let him leave his job at 55.

NEW YORK (Money Magazine)

Rule 5: A second paycheck comes in handy

No question, picking up a part-time gig after you walk away from 9-to-5 work will ease the pressure on your finances. And that's the plan for many: Three-quarters of workers believe they will have a job in retirement, a May Gallup poll found.

It's not just about the money. In a survey of 44- to 70-year-olds by the second-act job site Encore.org, a third of those who want to work part-time cited enjoyment as the reason.

But reality doesn't match expectations. In EBRI's 2013 Retirement Confidence Survey, only 25% of retirees report ever having worked for pay after calling it a career.

Would-be retirees are often unrealistic about landing meaningful part-time work, says Colorado planner Leitz. Lining up a 15- to 20-hour-a-week job sounds great, but there aren't too many stimulating and well-paying jobs in professional fields that allow that. "Flexibility is great for you, but not really for employers," says Leitz.

What to do

Go for projects, not a job. Even when firms don't want a 20-hour-a-week senior staffer, they still may have high-level work that needs to get done. Set yourself up to be the consultant they hire, says Dick Dawson of CareerCurve, a coaching firm for 55-plus workers.

Related: Will you have enough to retire?

Start where you're known: your old workplace and your network. Keep going to industry events and seek out contractors who do similar work and may hear of jobs they can't take. Visit elance.com and peopleperhour.com, which match employers with freelancers in fields such as marketing, writing, and design.

Make your hobby pay. Working doesn't have to mean sticking with the same career. Before retiring at 58, Susan Morgan Hoth was a high school teacher in Richmond who spent summers painting silk scarves. As she approached retirement, she started selling her scarves online through sites like Etsy.

Her business nets about $4,000 a year, enough to let Hoth, now 64, splurge more. "It helps me afford things I would not spend money on otherwise," she says.

Similarly, you might find that a part-time retail job that matches your interests -- in a golf shop, say, or a health-food store -- is all you need to pad your income. Discounts on greens fees or organic granola are an added bonus.

Don't get too comfortable. A lot can happen over 40 years, from a financial pinch to boredom. So even if you don't work out of the gate, keep yourself employable. That means maintaining professional credentials, following changes in your industry, and staying in touch with former colleagues.

Think way ahead. Many early retirees plant the seeds for a second paycheck well before retirement. One way to do that is by investing in rental real estate. Hearts & Wallets found that 27% of those who successfully retired before 62 went that route.

Related: Can you retire early?

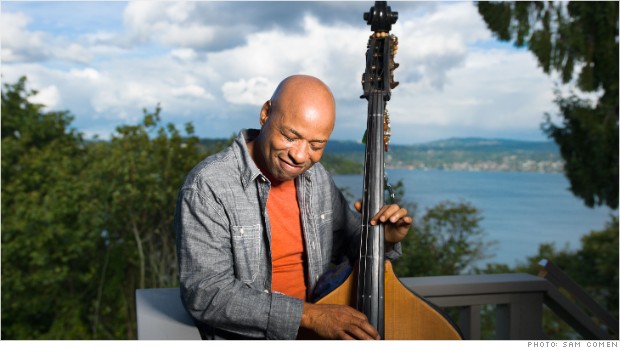

Rental income is what made it possible for Kevin Howard, 57, to leave his full-time job as a procurement manager for Boeing two years ago. In the mid-1980s he began rehabbing and renting out houses. The properties -- three in Seattle, where he lives, and one in his former hometown of Houston -- provide half his annual $140,000 income (the rest is a pension and savings).

Still, "I don't want to fix plumbing as I get older," he says. He plans to sell his Houston house soon and the others within five years.

Now, instead of working on aerospace projects, Howard is learning to play the standing bass. He's clocked 14,000 miles in 26 states on his motorcycle, and takes his VW Vanagon camper to blues festivals.

"I worked for 30 years," Howard says. "I want another 30 years doing the things I want to do."

MORE: New rules for early retirement

Rule 1: Early retirees: Don't fear losing your health insurance

Rule 2: Getting ready to retire? Save more, spend less

Rule 3: Use your home to boost retirement savings

Rule 4: Get the first decade of retirement right

Shrink your savings target

To retire early, you'll have to amass daunting multiples of your income (based on making $100,000). Working part-time until you get full Social Security softens the blow.

| 55 | 12.25 | 18 |

| 60 | 11.5 | 17 |

| 62 | 11 | 16 |

NOTES: Replace 70% to 75% of income in retirement; distribution rates of 3.25% to 4.5% depending on age and part-time income; 4% real returns; Social Security at full retirement age; part-time work replacing 30% of pre-retirement income until age 65. SOURCE: Charles Farrell, Northstar Investment Advisors

First Published: October 28, 2013: 3:05 PM ET

![]()